Brand Matters: What Consumers Really Think About ALP

When provocative pundit Tucker Carlson launched his new nicotine pouch brand, ALP, the buzz was undeniable.

With flavors like Refreshing Chill and Sweet Nectar, and nicotine levels of 3mg, 6mg, and a robust 9mg, ALP has positioned itself as a disruptor in a market dominated by other brands. However, the reception of this new contender raises important questions, like, does Carlson’s controversial public persona help or hinder ALP’s appeal?

We recently conducted a survey with Censuswide, collecting insights from over 2,000 adults who use nicotine in various forms. The aim was to explore how product preferences, perceptions, and politics intersect.

Where Does ALP Fit In?

According to the survey, smokers still lead the pack with 85.26% of respondents saying they use cigarettes, while newer alternatives, like nicotine pouches, account for just under 10% of users (9.54%).

Nicotine users aged 21-34 show the greatest openness to trying new products like ALP, suggesting a promising market for young brands.

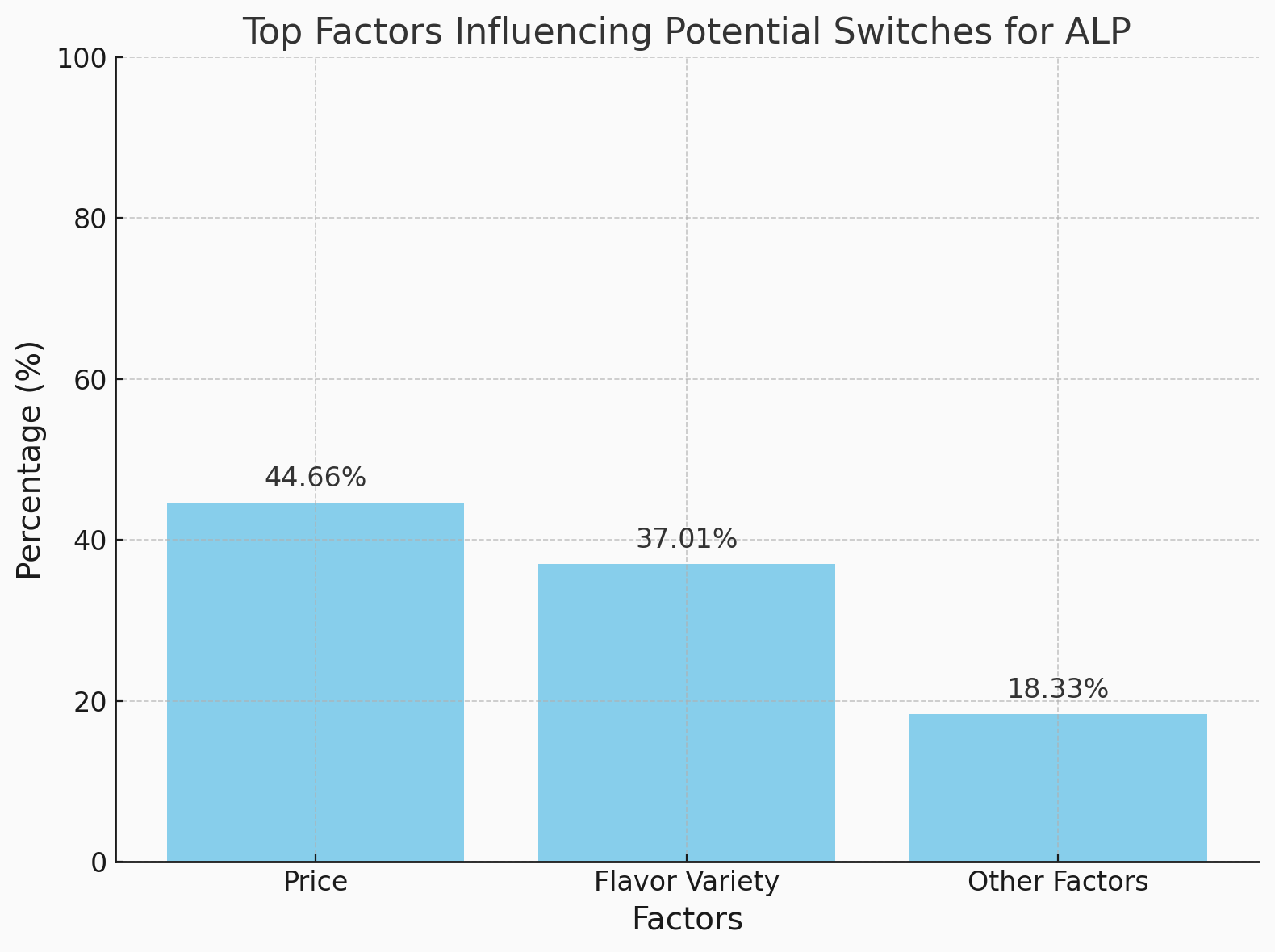

Among those curious about ALP, the top factors influencing their likelihood of switching pouches were price (44.66%) and flavor variety (37.01%).

With 5 flavors in competitively priced multipacks, ALP seems poised to attract attention. However, awareness remains a significant hurdle. When asked, only 17.53% of respondents had heard of ALP before. Awareness was highest among younger adults and lowest among those aged 55 and older, indicating that ALP has significant room for growth in brand recognition across various demographics.

Shifting Perceptions of Harm

A standout finding from the survey – at least for us – is the lingering misconception of harm associated with nicotine pouches.

- Almost half of the smokers surveyed (47.89%) mistakenly believe that pouches are as harmful as cigarettes.

- Even among nicotine pouch users, a whopping 29.27% are unaware of the different health implications between categories.

This presents a major opportunity for brands to educate the public on the documented risks of combustible tobacco compared to nicotine pouches. It’s important to note that many individuals still associate nicotine with smoking-related diseases; however, research has shown that the actual harm comes from the toxic chemicals found in cigarette smoke, rather than nicotine itself.

As the newest kid on the block, we can't help but wonder whether ALP will step up by emphasizing harm reduction through transparent, science-backed marketing, or simply rely on word-of-mouth to spread awareness.

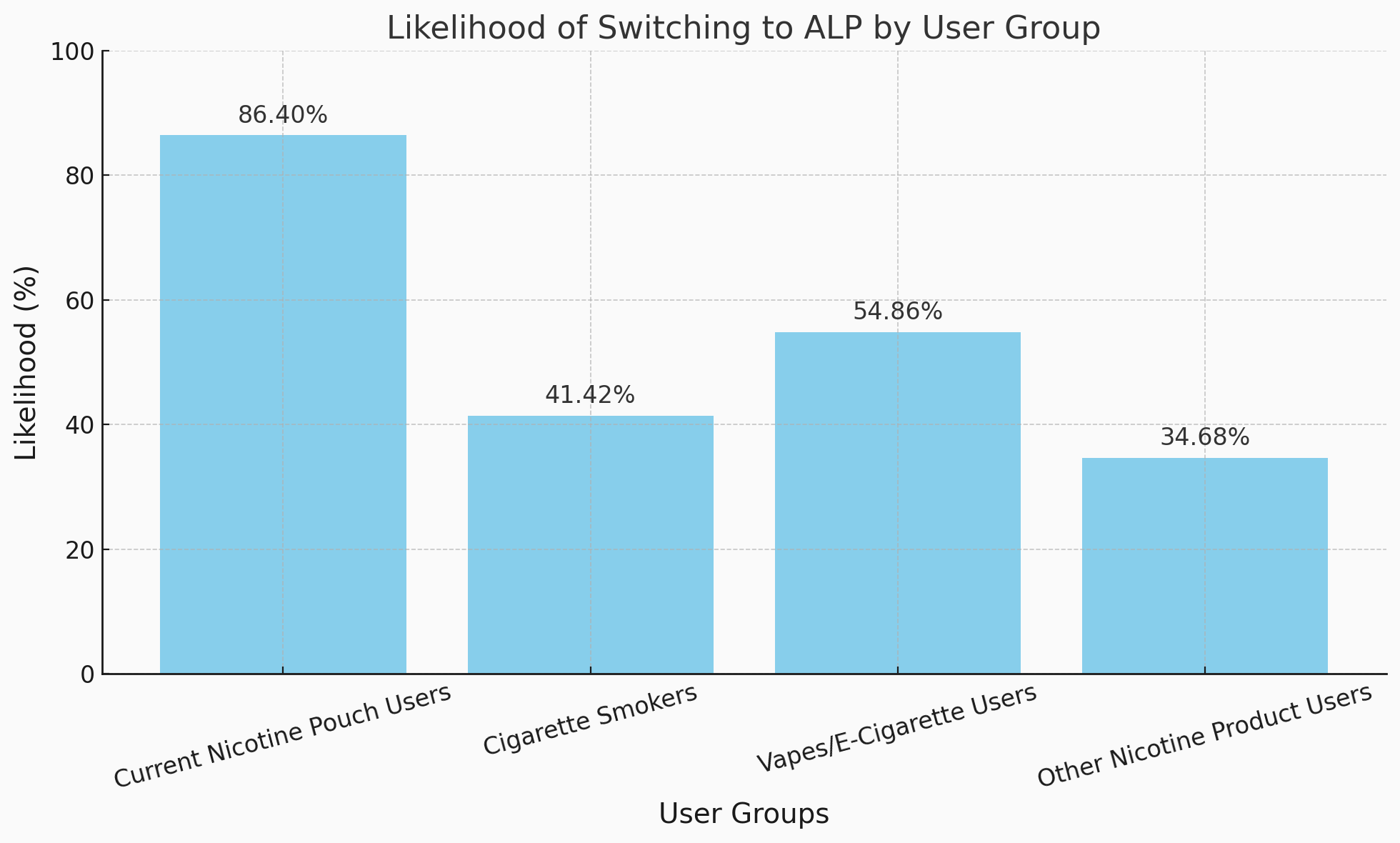

Overall, the survey revealed interesting trends in brand-switching behavior across the different nicotine user groups.

While nicotine pouch users are by far the most likely to try ALP, smokers represent a significantly untapped market.

Emerging brands should take note: Targeted campaigns that emphasize harm reduction, affordability, and flavor could encourage users to make the switch.

How Likely Are Users to Switch to ALP?

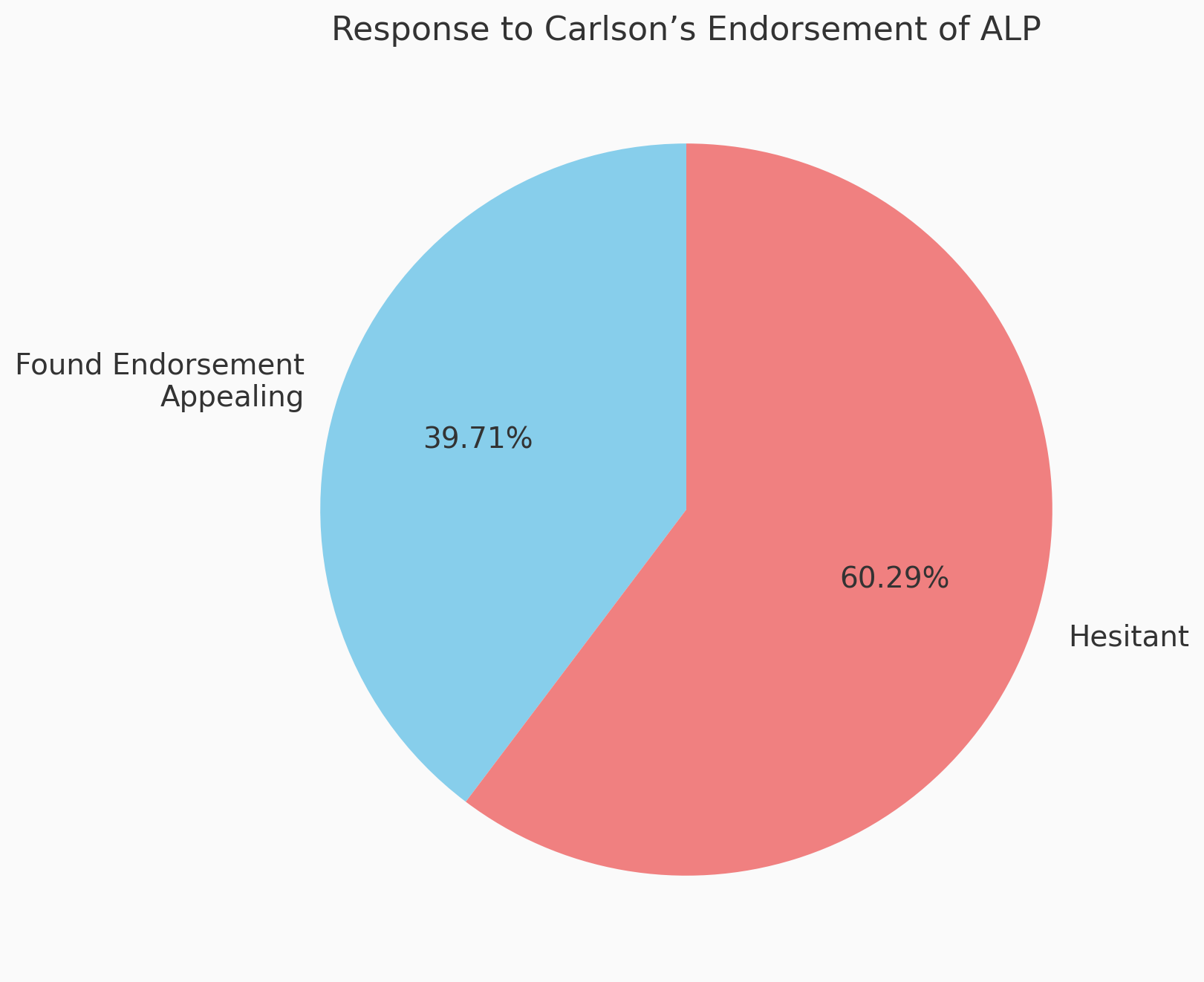

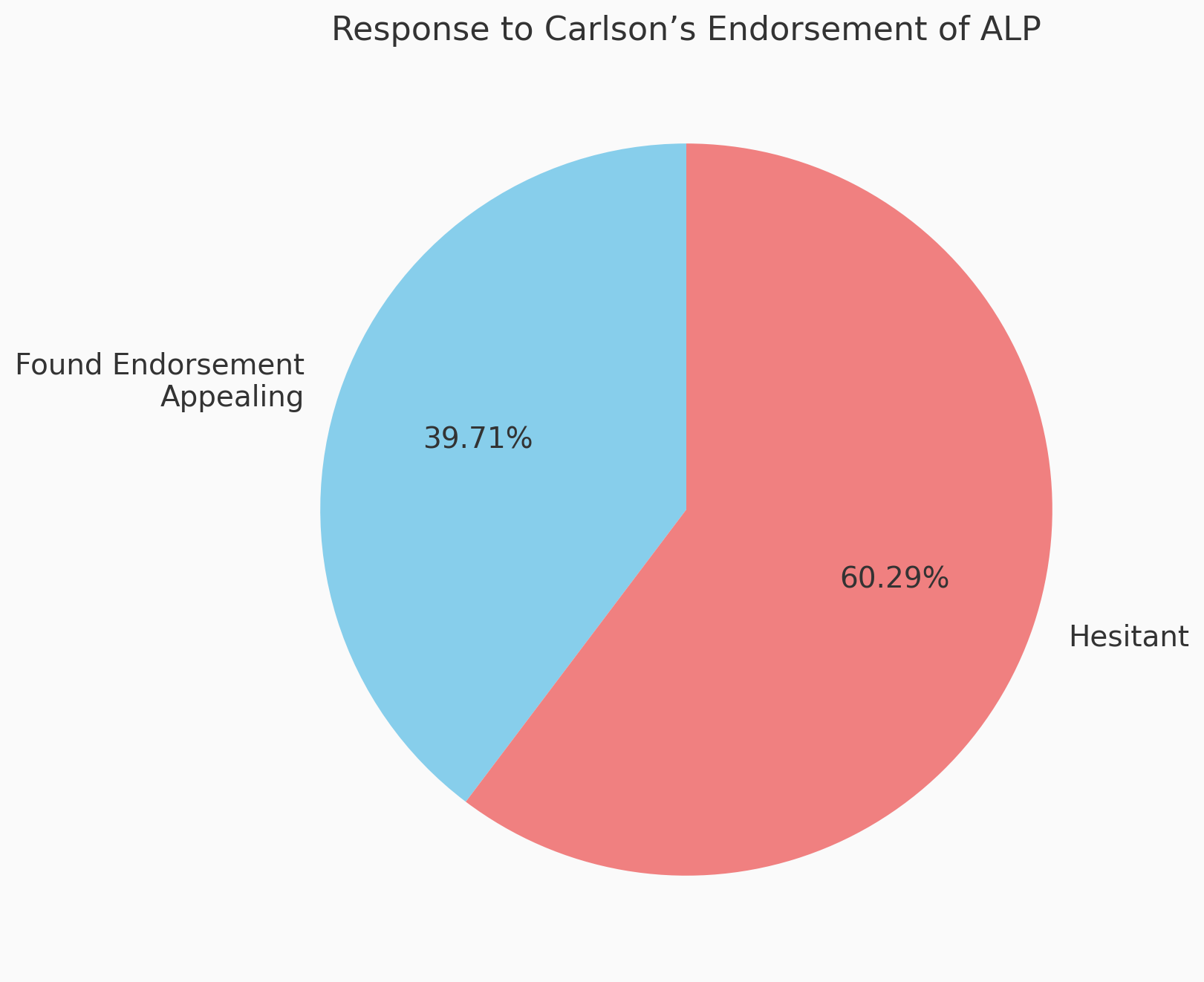

Carlson’s involvement generated mixed reactions for ALP, with 39.71% of respondents finding his endorsement appealing—especially in the South and Midwest—while others expressed hesitance due to personal or political reasons, indicating that Carlson's polarizing nature could limit ALP's appeal among certain demographics.

It'll be interesting to see how ALP balances its strong brand identity with broad consumer appeal, particularly given Carlson’s right-wing political involvement. While ALP promises to donate a portion of every sale to three causes that align with its values, this challenge raises the question of whether the company can avoid isolating certain groups or if it will adopt a divisive 'us vs them' rhetoric compared to competitors.

Politics Meets Nicotine

Nicotine choices are influenced by more than just taste or habit. Censuswide's survey found that 51% of respondents do take a brand or endorser's values into account when making a purchase, with younger users (58%) particularly swayed by their personal beliefs.

Can ALP Redefine Nicotine Pouches? Our Key Takeaways

While there's undeniable interest surrounding ALP, the brand may face significant hurdles. Many users wrongfully still associate nicotine pouches with cigarettes, indicating a critical need for educational outreach. With brand recognition at just 17.53%, it's clear ALP must also invest in visibility and targeted marketing to break through to consumers.

Carlson’s backing of the brand may resonate with a portion of the audience, but also carries the risk of alienating others with 12% expressing skepticism about Carlson himself. To navigate these complexities, ALP will need a careful messaging strategy that resonates with diverse consumer perspectives.

Looking ahead, ALP’s success will hinge not just on the quality of the products (we're yet to test) but also on their ability to inform users and inspire trust. By focusing on harm reduction, flavor variety, and raising awareness on the effects of nicotine, there is certainly potential for ALP to carve out their own niche in the nicotine market.

While the future remains uncertain—whether it sparks lasting change or fizzles out—one thing is clear: ALP is igniting conversations and challenging the status quo.

Login and Registration Form