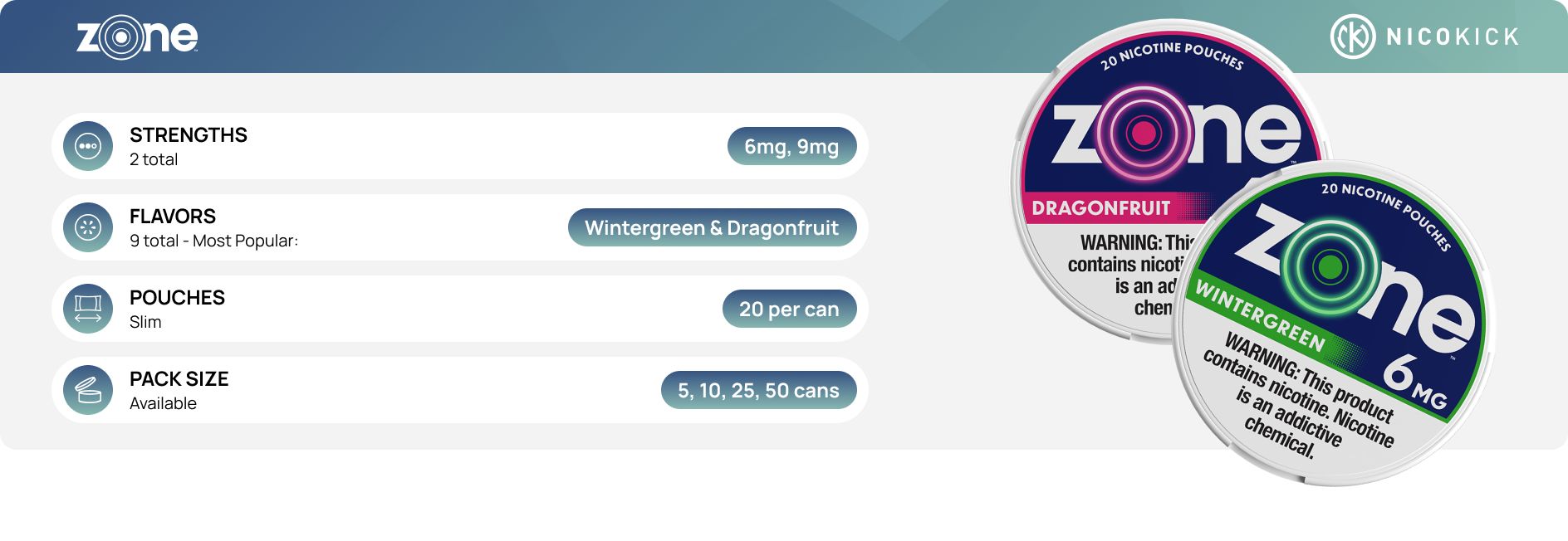

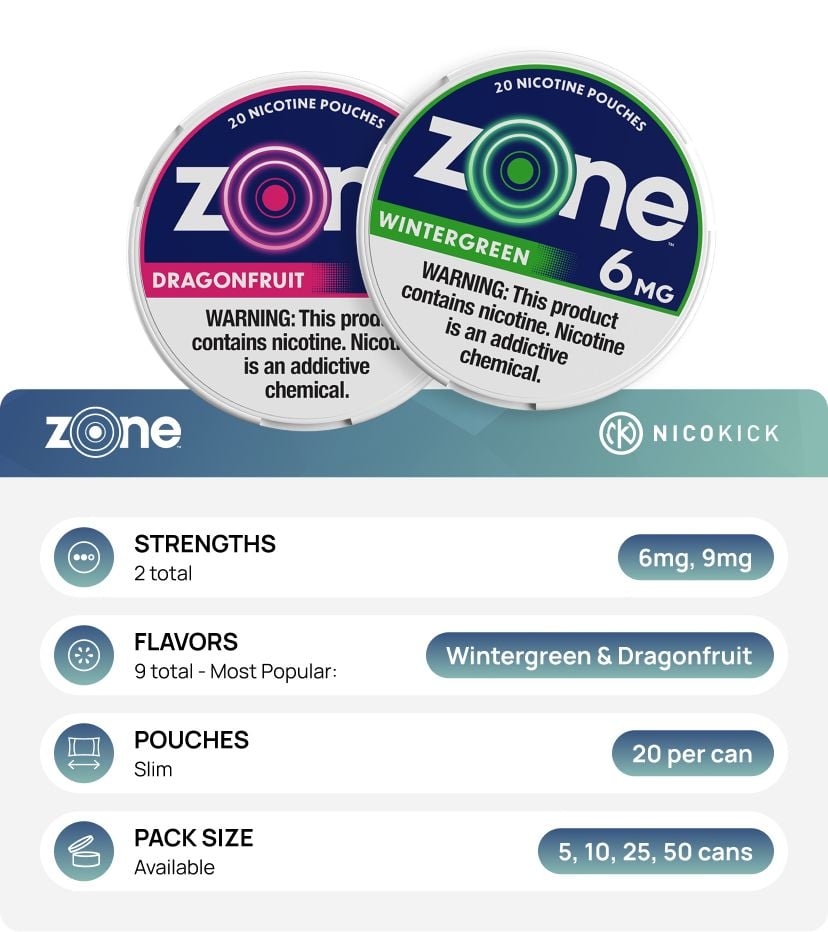

zone Key Features

zone nicotine pouches are the latest innovation from ITG Brands. They’re available in 9 different flavors and contain zero traces of tobacco since they’re made with premium synthetic nicotine. The extra soft material of their pouches sets a new standard for comfort and has the added benefit of locking in both flavor and moisture for a longer-lasting nicotine experience.

With zone, you get:

- Pharmaceutical-grade synthetic nicotine

- 20 slim, soft pouches in every can

- 9 flavors (including 2 unflavored)

- Use anywhere, anytime convenience

- Cans with a built-in waste compartment for used pouches

zone Flavors & Nicotine Strengths

For flavor and intensity that lasts, you can’t go past zone. Check out their entire range stocked on Nicokick with 4 popular mints, 2 fresh fruits, a tobacco-free Tobacco and 2 unflavored varieties to suit both Regular and Strong preferences.

| Flavor | Available Strengths |

| Wintergreen | 6mg, 9mg |

| Mint | 6mg, 9mg |

| Peppermint | 6mg, 9mg |

| Spearmint | 6mg, 9mg |

| Citrus | 6mg, 9mg |

| Dragonfruit | 6mg, 9mg |

| Tobacco | 6mg, 9mg |

| Smooth | 6mg, 9mg |

| Chill | 6mg, 9mg |

zone 6mg vs 9mg

When it comes to strength, zone gives you the choice between:

Both strengths cater to different needs, allowing you to choose the level of intensity that suits your lifestyle best. Keep in mind that certain flavors (like Spearmint or Citrus) can impact the perception of pouch strength for some.

It’s worth noting too that zone’s ultra-soft material has been specifically developed to release flavor for longer and prevent drying out, so not only do you get a better mouthfeel but also more out of every pouch.

Popular zone Pouches

These are the top 3 zone pouches you’ll find in Nicokick shopping carts right now:

The Story Behind zone

Since launching in the US at the beginning of 2024, zone has set a high bar in terms of pouch comfort and user experience with their lineup of 9 premium flavors—not to mention a synthetic nicotine formulation that many users say is longer lasting than other brands. Brought to you by ITGB, they’ve quickly become a go-to choice for adult nicotine consumers looking for the convenience of smokeless nicotine without having to compromise on their experience.

Customer Reviews

But don’t just take our word for it! Check out these reviews from real Nicokick customers who keep coming back to buy more zone.

⭐⭐⭐⭐⭐

"I'm just getting into the fruit flavors and trying various brands. These pouches are slim and moist, full of flavor. I will be buying more for sure."

Ryan C.

September 25, 2025

⭐⭐⭐⭐⭐

“Have tried a lot of pouches... This is definitely the best one I’ve had and I will continue to use these. Tastes good and pretty strong nic level. Great value for the price compared to others too!"

Daniel C.

May 17, 2025

⭐⭐⭐⭐⭐

“[zone] is my favorite. They are hard for me to find in stores sometimes, so I like the convenience of ordering online in bulk.”

Guest

April 6, 2025

Explore zone Pouches Online with Nicokick

Nicokick makes it easy to explore zone nicotine pouches. Not only has our community of users left hundreds of product reviews to help guide you towards the right pouch, we also offer:

- Competitive pricing that’s typically better than what you’ll find in-store;

- Exclusive mixpacks of 5 zone flavors in your choice of 6mg or 9mg strengths;

- Bulk-buy options and home delivery;

- A freshness guarantee on all products;

- Dedicated customer support should you have any questions about your order;

- Plus! The possibility to earn points and redeem discounts by joining our rewards program.

FAQs

Anyone purchasing nicotine pouches, like zone, must be at least 21 years of age. We take this requirement seriously and have two-step age verification in place—both when confirming your order and receiving the delivery.

Inside every can of zone you’ll find 20 slim, ultra-soft pouches.

There's a total of 9 zone pouches available on Nicokick in both 6mg and 9mg strengths. Their flavors include Wintergreen, Mint, Peppermint, Spearmint, Citrus, and Dragonfruit with 3 more pouches that are considered unflavored: Smooth, Chill, and a tobacco-free Tobacco.

All zone nicotine pouches contain pharmaceutical-grade synthetic nicotine, fillers, sweeteners, pH adjusters, and flavorings.

It’s fine to swallow any excess saliva you might produce while using zone, but you should never chew or ingest the actual pouch.

zone nicotine pouches are manufactured by TJP Labs under contract for ITG Brands.

FAQ

Anyone purchasing nicotine pouches, like zone, must be at least 21 years of age. We take this requirement seriously and have two-step age verification in place—both when confirming your order and receiving the delivery.

Inside every can of zone you’ll find 20 slim, ultra-soft pouches.

There's a total of 9 zone pouches available on Nicokick in both 6mg and 9mg strengths. Their flavors include Wintergreen, Mint, Peppermint, Spearmint, Citrus, and Dragonfruit with 3 more pouches that are considered unflavored: Smooth, Chill, and a tobacco-free Tobacco.

All zone nicotine pouches contain pharmaceutical-grade synthetic nicotine, fillers, sweeteners, pH adjusters, and flavorings.

It’s fine to swallow any excess saliva you might produce while using zone, but you should never chew or ingest the actual pouch.

zone nicotine pouches are manufactured by TJP Labs under contract for ITG Brands.

Login and Registration Form